🔎 Larger global corn harvest and Russian wheat availabilities could pile further moderate pressure on prices.

For wheat, harvests in the USA, Canada, EU27, and Ethiopia, are all larger than previously expected. By contrast in Australia and Argentina, growing conditions have deteriorated.

The corn harvests have begun in the northern hemisphere, with expected production revised higher in the USA (larger acreage) and to a lesser extent the EU27, Canada, Russia, and South Africa.

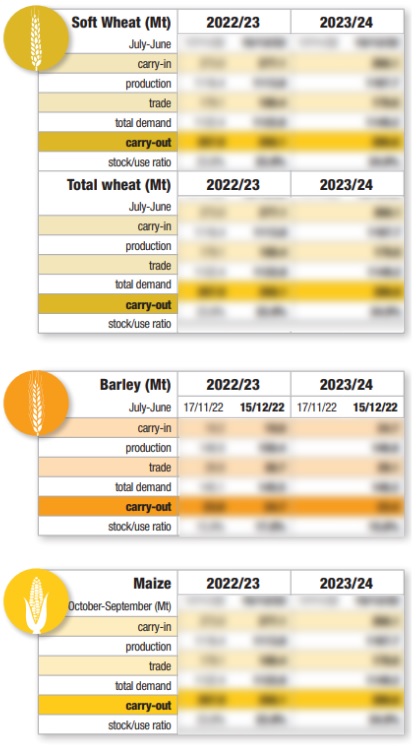

World wheat production is still projected significantly smaller than in 2022/23 but should reach nevertheless its second-highest level on record.

World barley production is still expected to decrease to a greater extent year-on-year, notably in Russia and especially the EU27, and Australia. For corn, the opposite is true: world production is projected much higher than in 2022/23, bouncing back almost to the record level of 2021/22.

Trade and Demand

In terms of trade, Russia continues to make its mark on the wheat and barley markets, imposing fierce competition against rival origins, especially for barley. Russian exports of both wheat and barley are now expected to reach all-time highs in 2023/24.

Meanwhile, Australian exports of barley and especially wheat are forecast to fall drastically year-on-year, against the backdrop of smaller harvests. This season’s Australian harvest is affected by drought, caused by the El Niño weather phenomenon.

Russian cereals are capturing some potential demand from EU grains, given that supplies of European barley are smaller this year and that European wheat is currently less competitive. French exports have been all the same active to China, limiting the decrease of European exports.

On the corn market, export trade is currently dominated by Brazil, although given the expectation of a much larger harvest, the USA should be able to step up its exports in 2023/24. This should also be the case for Argentinean exports, assuming more usual harvest levels can be restored. Early corn plantings are underway in Argentina, but rains are still awaited after the severe drought that pushed down production in 2022/23.

Meanwhile, projected global demand has increased this month, in line with the larger expected corn and wheat harvests; however, we continue to forecast only a moderate demand recovery.

Outlook for 2023/24

For marketing year 2023/24, our balance sheet for world wheat shows a situation barely at equilibrium. Tight supply is essentially concentrated in North America, whilst potential inventories in other exporting countries are higher, particularly in Russia and Ukraine.

The world market outlook is tighter for barley, with lower stocks than last season forecast in Russia, EU27, and Australia. Contrastingly, world corn stocks look set to rise sharply, particularly in the USA. The world corn market could even see stocks settle at a relatively comfortable level by the end of 2023/24.

➡️ We still forecast that wheat prices will decrease moderately between now and the end of the marketing year. Prices of west EU wheats could fall most sharply, followed by Russian wheat prices, to a lesser extent.

➡️ West EU barley prices have a small decrease potential due to the impact of competition from Russian barley, and downwards pressure from the wheat and corn markets in general. Russian barley prices could end up lifting significantly.

➡️ US corn prices have the greatest downside potential, amid pressure from US corn. Russia’s unofficial price floor policy for wheat (270 $/t FOB) will need to be closely monitored. The extent of downwards price pressure from corn will also depend on harvest levels across the northern hemisphere, with the results of the US harvest being critical.

Français

Français